SBI looking to ease KYC burden: Chairman C S Setty

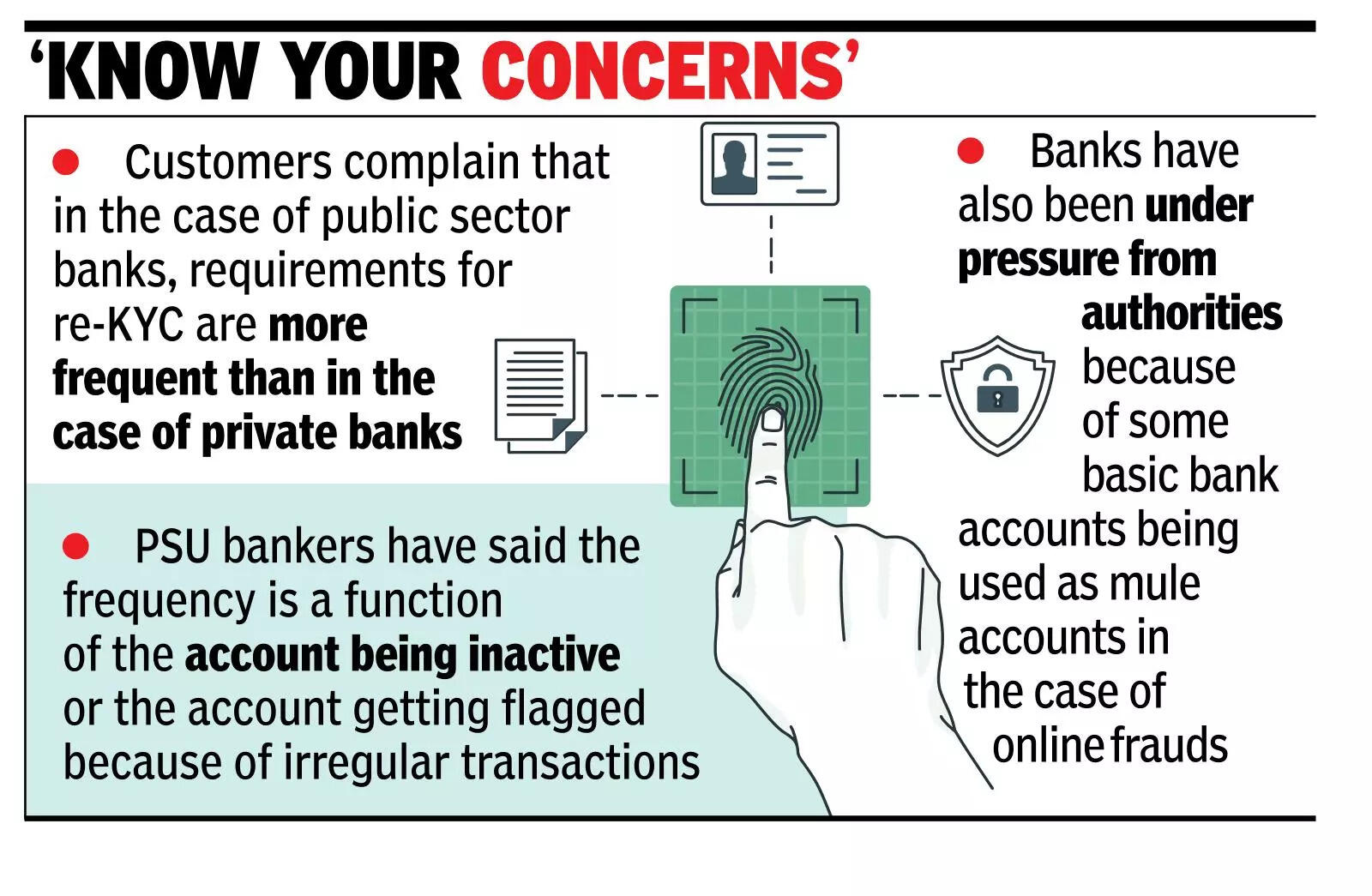

MUMBAI: The country’s largest lender SBI is engaging with regulators to simplify its ‘know your customer’ (KYC) process, chairman C S Setty said, underlining the bank’s efforts to improve access and quality of financial services. “Simplifying KYC and re-KYC processes is critical for both customers and banks. We are taking initiatives from SBI’s side to engage with regulators and simplify the process,” he said.Despite its intent to update customer data and curb fraud, varying practices have made re-KYC a compliance hassle for many Indians. Some customers have complained that they are called for re-KYC once in two years and faced the risk of being barred from transacting on their bank accounts if they did not comply.Customers have complained that in the case of public sector banks the requirements for re-KYC are more frequent than in the case of private banks. PSU bankers said that the frequency is also a function of the account being inactive or the account getting flagged because of irregular transactions. Banks have also been under pressure from authorities because of some basic bank accounts being used as mule accounts in the case of online frauds.

Earlier, in an interview to TOI, RBI governor Sanjay Malhotra had said that customer convenience remains a key priority and simplifying KYC is central to that effort. He said that the effort was to ensure that once KYC is completed with one regulated entity, it should apply across all others, and address updates should automatically reflect but no specific timeline has been set for full implementation.Speaking at the Global Fintech Fest here on Wednesday, Setty noted SBI’s combination of digital and physical presence. “We have about 1.6 lakh touch points today. It is not only digital channels; we are also reimagining physical outlets to ensure services are accessible across the country,” he said. SBI’s contact centres handle over 60% of traffic from rural and semi-urban areas, providing services in 15 languages, reflecting the bank’s focus on inclusive banking.Setty stressed serving India’s diverse customer base, from first-time account holders to high-net-worth individuals. “Providing scale and access is a challenge given India’s demographic and geographic diversity. Today, our 520 million customers are never denied service, whether it is basic banking or wealth management,” he said.Technology has accelerated customer onboarding. “Earlier, onboarding at a branch could take an hour. Today, using e-Aadhaar and the reimagined Yono portal, we complete it in 10-15 minutes,” Setty said. SBI’s Yono 2.0 app will expand to 15 languages and focus on products for farmers, MSMEs, and financial customers.On financial inclusion, Setty noted SBI’s 2.5 million business correspondents provide 33 banking services across rural, semi-urban, and urban areas. He pointed to PMJDY (PM Jan Dhan Yojana) accounts: 150 million gender accounts opened, 99.5% funded, with 56% operated by women.Setty also noted that one-third of SBI’s customer base is under 35 and stressed life-cycle financial management, including education loans.